gusto colorado paycheck calculator

Revolution skincare blemish 2 salicylic acid mask Show sub menu. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

Warner bros cartoons list.

. With this option your payroll automatically runs each pay period without any special input. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Sacramento airport news today.

Best lake towns near chicago. How to cut sides of hair with scissors. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado paycheck calculator.

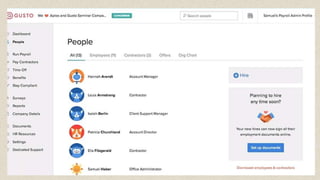

Employers must report new or rehired employees within 20 days of hire through the Michigan New Hires Operation Center. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Home mstour colorado paycheck calculator.

State unemployment insurance SUI tax. This number is the gross pay per pay period. Sök jobb relaterade till Gusto hourly paycheck calculator eller anlita på.

The standard FUTA tax rate is 6 so your max contribution per employee could be 420. Hourly employees who work more than 40 hours per week are paid at 15 times the regular pay rate. Free Salary Paycheck Calculator.

Texas Unemployment Insurance UI is paid on the first 9000 in wages you pay each employee every calendar year. Couriers and Express Delivery Services. You can pay employees aged 16 to 17 at 85 of the minimum wage.

Important Note on Calculator. Colorado Hourly Paycheck Calculator PaycheckCity More than 200000 small businesses and their teams trust Gusto. Switch to Colorado salary calculator.

Colorado Hourly Paycheck and Payroll Calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. To calculate an annual salary multiply the gross pay before tax.

Gusto paycheck calculator The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. Use this federal gross pay calculator to gross up wages based on net pay. Check out the Texas Workforce Commissions website to find your current tax rate.

Or Select a state. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Colorado. Switch to Colorado hourly calculator.

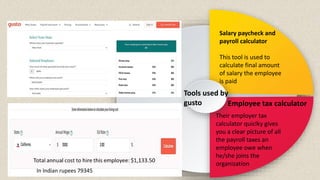

The colorado salary calculator will show you how much income tax you will pay each paycheck. Price of this payroll tax calculator software starts from 289635 per user per month. This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Gusto Paycheck Tax Calculator Pricing. Colorado Salary Paycheck Calculator. Gusto illinois paycheck calculator.

Colorado Hourly Paycheck Calculator. Gusto illinois paycheck calculator. Michigan allows employers to pay 425 per hour for the first 90 days to train new employees aged 16 to 19.

One nice aspect of the system is the autopilot setting. Colorado Paycheck Quick Facts. Bird scooter for sale ebay near paris nissan rogue vs dodge journey.

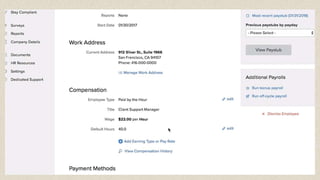

Workers compensation insurance is required when a company has at least three employees including part-time workers. Gusto allows you to make payments to your employees and contractors via direct deposit printed check or prepaid debit card. By May 10 2022 samsung note 3 neo release date.

Federal Hourly Paycheck Calculator. With unlimited payroll runs and automatic tax filing Gusto helps small-business owners worry less about payroll and put more time into growing their business. Baseball analogy for dating.

This Colorado hourly paycheck calculator is perfect for those who are paid on an hourly basis. Gustos payroll benefits and HR platform is trusted by more than 200000 businesses and their teams. Gusto colorado paycheck calculator.

Press enter to begin your search. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Your tax rate is calculated using several factors and can change each yearthe minimum tax rate is 036 and the maximum rate is 636 in 2019.

However you can also claim a tax credit of up to 54 a max of 378. Unlike most hr platforms zenefits payroll system automatically syncs with the rest of hr making your life a little bit easier. Luxury apartments capitol hill seattle.

For 2022 the minimum wage in Georgia is 725 per hour. Powerball double play winning numbers tonight 2021.

How To Do Payroll In Excel In 7 Steps Free Template

Free Salary Paycheck Calculator Business Org

Cuprinzător Da Naștere Inmormantare Pay As You Earn Tax Calculator Schwarzwald Hotel Org

Hourly Paycheck Calculator Sale Online 50 Off Laparrilladesanlorenzo Es

How To Do Payroll In Excel In 7 Steps Free Template

Hourly Paycheck Calculator Factory Sale 57 Off Equipatetrailrunning Com

Here S How To Read A Pay Stub With Sample Paycheck Youtube

Calculator For Paycheck Online Discount Shop For Electronics Apparel Toys Books Games Computers Shoes Jewelry Watches Baby Products Sports Outdoors Office Products Bed Bath Furniture Tools Hardware Automotive Parts

Cuprinzător Da Naștere Inmormantare Pay As You Earn Tax Calculator Schwarzwald Hotel Org

How To Do Payroll In Excel In 7 Steps Free Template

țară Pasiune Mie Florida Tax Calculator Schwarzwald Hotel Org

Quick And Dirty Payroll For One Person S Corps Evergreen Small Business

404 Error Page Not Found Green Valley Ranch Nevada The Neighbourhood